Jonathan Levin: Powell's caution on tariff-driven inflation is right

Published in Op Eds

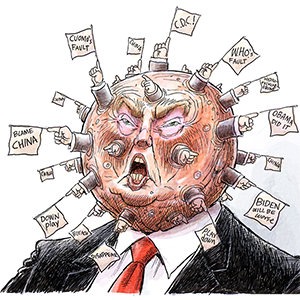

President Donald Trump has taken to routinely maligning Federal Reserve Chair Jerome Powell as “too late” because interest rates have been on hold at 4.25%-4.5% since he took office.

On Tuesday alone, he characteristically took to social media to demand three percentage points of rate cuts — something that is never going to happen outside of a recession. Trump’s needling aside, the latest inflation data show that Powell’s wait-and-see approach is the exact right tack for today’s economic outlook.

The Bureau of Labor Statistics said Tuesday that the core consumer price index rose 0.2% in June from a month earlier, a slightly encouraging surprise that leaves the year-over-year rate at 2.9%. But the reading remains well above the Fed’s 2% target(1), and the details of the report show that tariffs are starting to fan higher prices and that larger effects might start to feed through over the next couple of months.

More specifically, core goods rose 0.2% in June from a month earlier, the most brisk pace since February, driven in large part by a jump in household furnishings and supplies — a telltale sign of tariff passthrough. That category (think appliances, rugs, housekeeping supplies, etc.) jumped by 1% from the prior month, the biggest such increase since January 2022. Also notching the biggest month-on-month jump since 2022 were recreation commodities (sporting goods, toys, video equipment, etc.). Not only were tariff impacts undeniable this month, they appeared to be broadening out from what had been a very light and scattered influence in previous months’ data.

Still, this was neither a month to panic nor celebrate. With the backdrop of a steady unemployment rate, it’s time to do as the embattled Fed chair — whom Trump has committed to replacing when his term is up next year — has been advising all along: Wait for more data.

Among Fed policymakers and private sector economists, the general view of tariffs has been that they would hit sometime over the summer. For starters, Trump’s biggest and broadest tariff salvo didn’t come until April. Goldman Sachs Group Inc. economists estimate that it takes about a month for many imports to reach U.S. shores, and goods were exempt if they were already on the ship at the time of the “Liberation Day” duties.

What’s more, businesses stockpiled inventory in advance of the deadline and Customs and Border Protection allows many importers to delay payments for up to a month and a half. Hence, many forecasters expected June to be the start of a tariff-impact story that could become more evident in July and August.

Powell has been broadly in that camp. At the post-decision press conference in June, he said that he expected to learn more “over the summer” about tariffs. “We hadn’t expected them to show up much by now, and they haven’t,” he said. “And we will see the extent to which they do over the coming months.” In markets, his comments have been broadly interpreted to mean that further rate cuts were possible (though hardly guaranteed) as soon as September, and that still feels appropriate. By that time, the committee will have additional inflation data in hand for the months of July and August.

Unfortunately, Trump has used his social media platform to advocate for more immediate cuts, and his Council of Economic Advisers recently published an analysis that found no evidence that tariffs have caused “any economically meaningful inflation.” Inflation Insights President Omair Sharif wrote Monday that the CEA had gotten ahead of itself. “Setting aside the methodology for a moment, if the main point of the CEA’s analysis is to suggest that tariffs are not impacting inflation, then I think they’ve spiked the ball at the 50-yard line,” he said.

It’s entirely possible, of course, that tariff impacts could spread further and that the Fed will still lower policy rates. The central bank doesn’t have to wait for inflation to return to 2% to start lowering rates again; rates are clearly at a level that the median Fed policymaker would deem restrictive. Powell and his colleagues just need to gain confidence that it remains on the right trajectory.

Furthermore, tariffs are generally seen as a one-off increase in prices — the sort of supply shock that monetary policy orthodoxy would tell you to “look through.” The ultimate question as it pertains to trade policy is whether tariffs will shock expectations to such an extent that inflation gets back into the bones of the economy. That may depend on both the magnitude of the tariff impacts and their duration. And all of those variables depend, in turn, on whether Trump decides to temper the policies — as he’s occasionally proved willing to do, especially when financial markets react badly.

To some extent, monetary policy will also depend on what happens with other key categories in the inflation basket. Among major imported goods, the auto sector is a big question mark. While tariffs are driving up car prices and threatening profit margins, the government data showed that prices of both new and used vehicles fell in June from May — a reminder that the duties aren’t the only consideration. Dealers are also contending with high borrowing costs and a general affordability crunch that’s weighing on demand. Many are uncertain about whether they can increase prices without hitting customer traffic and market share.

What’s more, it’s important to remember that core services — which aren’t directly impacted by the tariffs — still constitute about three quarters of core CPI and about two thirds of inflation overall. As such, it’s plausible that services disinflation could mitigate the jumps in certain core goods prices, especially if shelter inflation remains as tame as it’s been for the better part of 2025. With all the crosscurrents, the responsible solution is for policymakers to wait for more evidence, and that’s exactly what the Fed is doing under Powell’s stewardship. No matter what the partisans around the White House say, the chairman is handling tariff uncertainty about as well as you could ask for.

(1) The Fed's target is technically based on the personal consumption expenditures price index, which will be released later in the month. Core CPI constituents feed into that calculation and the two gauges currently produce similar assessments about the state of U.S. inflation.

_____

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Jonathan Levin is a columnist focused on U.S. markets and economics. Previously, he worked as a Bloomberg journalist in the U.S., Brazil and Mexico. He is a CFA charterholder.

_____

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments